Green Steel Making - Innovation & Market

- Boolean IP Team

- Sep 7, 2022

- 2 min read

Updated: Jul 14, 2024

This report is commissioned to examine the global innovation, market & patenting

trends in the domain of Green Steel Making, in particular based on study of patent

filings after 2000 and secondary market study.

Earliest patent applications in Green Steel Making have been filed in 1990s but a

continuously rising patent activity in this domain started after 2000, with the highest

number of patent applications filed after 2014. Accordingly, this study was restricted

to patents filed after 2000. Looking at high number of filings happening in this domain

by enterprises of all sizes, universities, and researchers etc., it becomes much vital to

have a keen evaluation of the patenting activity to understand the innovation trends.

The initial research aims to give the readers a clear insight regarding the comparative

patenting activity among different players in the domain. A closer look at the patenting

activity demonstrates a constant rise in the filing specifically after 2014 wherein a

steep rise globally can be observed.

This motivated us to take a deeper dive and analyze critically the various techniques

for making green steel. Further, various patent filing trends have been also evaluated

while also revealing the major players in each category. A comparative analysis of R&D

strategy and portfolio strength for few major players have been also evaluated.

Finally, a few driving factors and challenges have been identified in the study. And few

prominent insights and recommendations have been identified that may help the active

players evaluate the scope of their innovation & opportunities of expansion in this

domain.

INTRODUCTION

Steel is the world’s most important engineering and construction material. It is used in

every aspect of our lives; in cars and construction products, refrigerators and washing

machines, cargo ships and surgical scalpels etc. It can be recycled over and over again

without loss of property. Steel has a commendable hardness and strength due to which it is contributing to the technological development in industrial sector.

Steel is an alloy of iron and carbon containing less than 2% carbon and 1% manganese

and small amounts of silicon, phosphorus, sulphur, and oxygen. Steel is produced via

two main routes: the blast furnace-basic oxygen furnace (BF-BOF) route and electric

arc furnace (EAF) route. Variations and combinations of production routes also exist.

The key difference between the routes is the type of raw materials they consume. For

the BF-BOF route these are predominantly iron ore, coal, and recycled steel, while the

EAF route produces steel using mainly recycled steel and electricity. Depending on the plant configuration and availability of recycled steel, other sources of metallic iron

such as direct-reduced iron (DRI) or hot metal can also be used in the EAF route.

A total of around 70% of steel is produced using the BF-BOF route. First, iron ores are

reduced to iron, also called hot metal or pig iron. Then the iron is converted to steel in

the BOF. After casting and rolling, the steel is delivered as coil, plate, sections or bars.

Steel made in an EAF uses electricity to melt recycled steel. Additives, such as alloys,

are used to adjust to the desired chemical composition. Electrical energy can be

supplemented with oxygen injected into the EAF. Downstream process stages, such as

casting, reheating and rolling, are similar to those found in the BF-BOF route. About

30% of steel is produced via the EAF route. Another steelmaking technology, the open

hearth furnace (OHF), makes up about 0.4% of global steel production. The OHF

process is very energy-intensive and is in decline owing to its environmental and

economic disadvantages.

Despite being the core pillars of today’s society and providing one of the most

important engineering and construction materials, steel industry now needs to cope with pressure to reduce its carbon footprint from both environmental and economic

perspectives. The amount of CO2 emissions from steel manufacturing is almost double the amount of steel created: 1.85 tonnes of carbon per 1 tonne of steel.

In 2015, the global response to the threat of climate change took a step forward when

190 nations adopted the Paris Agreement. In 2019, the United Nations announced that

over 60 countries—including the United Kingdom and the European Union (with the

exception of Poland)—had committed to carbon neutrality by 2050, although the three

principal emitters China, India, and the United States were not among that number.

Moreover, some nations have pledged to work toward earlier dates. Together, these

agreements have led to growing pressure to pursue decarbonization across all

industrial sectors.

With global steel demand expected to rise to 2.5 billion tonnes per year by 2050, the

environmental burden is growing. Yet an analysis of the overall reduction in worldwide

carbon emissions needed to limit global warming to a maximum of 2 °C above

preindustrial levels—the goal of the 2015 Paris climate agreement—suggests that the

steel industry’s annual emissions must fall to about 500 million tonnes of CO2 by

2050. Achieving that target will require the industry to reduce its carbon intensity

from about 1.85 tonne of CO2 per metric ton of steel to just 0.2 tonne.

This study discusses innovation and market trends since year 2000 and anticipated

future market for green steel.

TECHNIQUES FOR MAKING GREEN STEEL

Steel can be produced via three main processes: using an integrated blast furnace

(BF)/basic oxygen furnace (BOF), an electric arc furnace (EAF), or a direct reduced iron

(DRI)/BOF process. While integrated players produce steel from iron ore and need coal as a reductant, EAF producers use steel scrap or direct reduced iron (DRI) as their main raw material. As the predominant production method globally is the conventional, coal dependent BF/BOF process, the need to assess alternative breakthrough technologies to reduce carbon dioxide emissions is high. The chart below discloses some of the techniques for making green steel.

As BF/BOF efficiency improvement programs only result in an incomplete reduction in

carbon dioxide emissions, they cannot be a long-term solution. Biomass reductants and carbon capture and usage are either only feasible in certain regions or still in the early stages of development. The share of EAFs producing high-quality steel will gradually increase but requires the availability of scrap and DRI. Hence, adopting an approach combining scrap, DRI, and EAF using hydrogen is currently considered the most viable option and the long-term solution to achieving green steel production.

TECHNOLOGY PATENT FILING TRENDS

Below chart shows a trend of patent filing in green steels manufacturing from year

2000-2021. The trend is continuously rising with few dips. It must be noted that

patent filing data is not complete for 2020 and 2021 since most of the patent

applications filed in these years would not have been published till date.

Below chart shows a trend of priority filings in green steel manufacturing from year

2000-2021 in Top 10 Jurisdictions. It must be noted that patent filing data is not

complete for 2020 and 2021 since most of the patent applications filed in these years

would not have been published till date.

OVERALL APPLICATION, GRANT VELOCITY & ESTIMATED EXPIRY

Below chart shows a trend of patent filing in green steel manufacturing from year

2000-2021 and applications’ grant year and expected expiry years. Most number of

applications were granted in this domain in the year 2002. It must be noted that patent

filing data is not complete for 2020 and 2021 since most of the patent applications

filed in these years would not have been published till date.

Non-unique items may be present in this chart. For example; families often contain patents from multiple years, or jurisdictions meaning that in some instances families can be counted more than once (once for each jurisdiction). The assumed expiry date (where applicable) is simply calculated as 20 years from the first grant. Any calculated expiry date further factors in any available specific legal status information. However, both are only as reliable as the data provided by the various jurisdictional patent offices. As with all legal event and status data they in no way constitute legal advice; a qualified patent legal practitioner should always be consulted with regard all pertinent matters.

OVERALL LEGAL EVENTS

Below chart shows the various legal events for all the patent applications in this

domain. A substantial amount of patent applications has been granted.

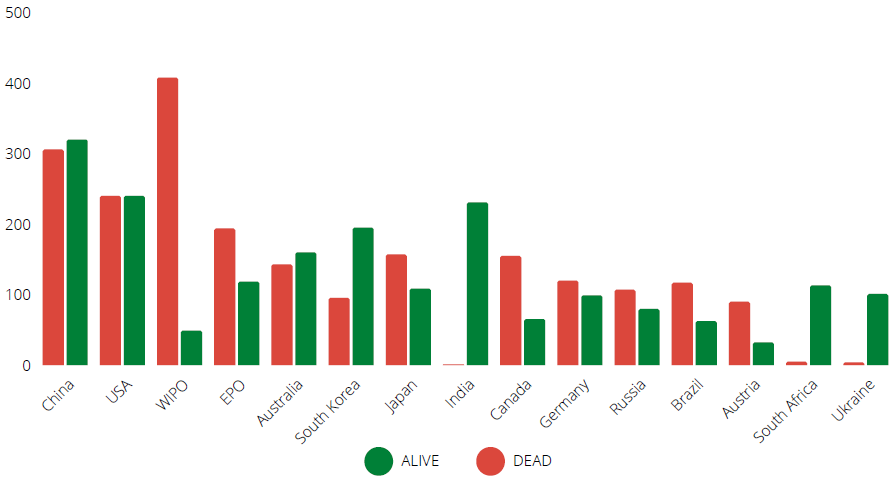

Below chart shows an active status of patent applications filed in Top 15 jurisdictions.

GEOGRAPHICAL COVERAGE OF PATENTING ACTIVITIES

The chart below shows the number of patent families published in Top 10 jurisdictions.

The technology is being protected in these countries which may denote that the

innovators are seeking these geographies as most favorable market for their invention.

More than 30% of the patent applications are filed in China, USA, and Japan.

The chart below shows the number of patent families first filed in Top 10 jurisdictions.

The technology is being first protected in these countries which may denote that the

innovations are originating in these countries. More than 60% of the patent

applications originated in China, Japan, and USA.

ACTIVE PLAYERS AND INNOVATORS

The chart shows the Top 15 players who have filed most applications in this domain.

The chart shows the Top 15 players who have the highest number of granted patents

in this domain.

TOP 5 ASSIGNEES COMPARATIVE ANALYSIS

FILING TRENDS

TOP 5 ASSIGNEES COMPARATIVE ANALYSIS

TECHNOLOGICAL FOCUS

The chart below shows the technologies for making Green Steel as focused by Top 5

assignees. The patent families for cleanest technology, being 'DRI utilizing green

hydrogen', among identified ones is owned by Posco followed by Primetals

Technology, Kobe Steel, Tata Steel, and Nippon in the respective order.

TOP 5 ASSIGNEES COMPARATIVE ANALYSIS

GEOGRAPHICAL COVERAGE

TOP 5 ASSIGNEES COMPARATIVE ANALYSIS

LEGAL STATUS

TOP 5 ASSIGNEES COMPARATIVE ANALYSIS

PATENT PORTFOLIO STRENGTH

The below chart has been prepared on the basis of relative scores for qualitative and

quantitative parameters to provide a clear comparison for patent portfolio strength for

Top 5 companies working for Green Steel Making. Our cumulative portfolio score

suggests that Kobe Steel has the best patent portfolio among the five assignees.

Though, Kobe's most patents are directed towards improving the efficiency of BF/BOF

and DRI processes.

Get in touch at info@booleanip.com to know more about cumulative portfolio scores.

GLOBAL STEEL MARKET

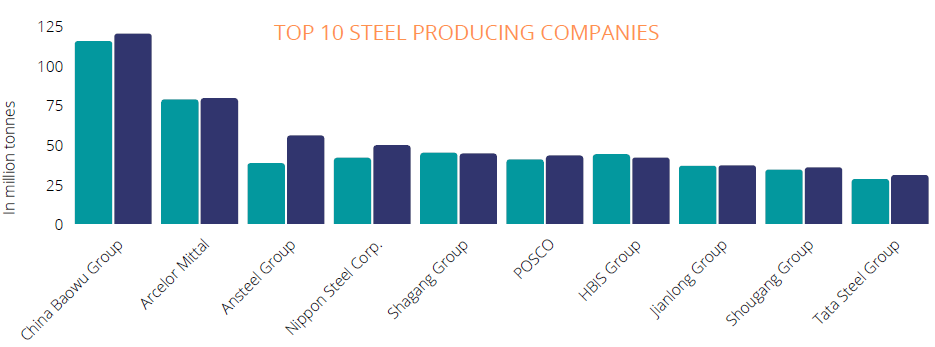

Over the last 20 years, the global crude steel production has continuously seen a rise

at an average rate of ~4%. The world crude steel production amounted to over 1.95

billion metric tons in 2021, a 3.8% rise compared to 2020. In 2020-21 China has been

the largest producer of crude steel followed by India, Japan, USA and Russia. The

European Union and the United States were the world leading steel importers in 2021,

recording respectively an import volume over 48 and 29 million metric tons. While the

Covid-19 pandemic did not contribute to a noticeable slump in production, a drop in

steel prices negatively impacted revenues from global leaders in the steel market such

as ArcelorMittal and Nucor Corporation.

The global steel market is expected to grow at a decent ~4% growth rate in the next

five years. Construction and transportation sector are the major driving factors of steel

market, as they consume two third of the global steel production. In the last two years,

construction and transport steel products has been among the most exported articles.

The global steel demand is expected to grow at 2.2% with the largest consumer being

Asia and Oceania.

GREEN STEEL MARKET - DRIVERS AND CHALLENGES

In 2022, the Global Green Steel Market is in its nascent stage and it is anticipated to

grow at ~5% CAGR till 2027. The stakeholders in the market are progressively

investing in setting up greenfield projects and establishing partnerships & strategic

alliances to transform their businesses. The global market is likely to be driven

primarily by the mounting inclination of governments toward lowering carbon

emissions and adopting sustainable products & manufacturing practices. Manufacturers now recognize that they need to produce steel more environment friendly. Their customers, too, are applying pressure, as they try to hit their own targets linked to indirect emissions.

Although, the technologies for producing green steel already exist such as 'EAF using

DRI' or 'increasing the scrap content in EAFs', there are operational challenges to

these. For running EAFs, power grids globally will need major upgrades to meet the

consumer demands. High quality scrap supply too is limited in quantity, and EAFs

cannot always produce the quality required for certain applications. An EAF using DRI

emits around 1.5 tonnes of CO2, making it dirtier than EAF using scrap but

significantly cleaner than the BF/BOF process. Production could get cleaner still if

hydrogen were to replace natural gas within the DRI process. That way, low-emission

green steel would be possible to manufacture.

According to a report from Bloomberg, steel production could be made with almost no carbon emissions through $278 billion of extra investment by 2050. At present, the

costs to produce green steel are challenging. It is estimated that that a DRI/EAF

process using hydrogen would add about $100 to operating costs per tonne of steel

produced. If, however, the cost of hydrogen were to reduce – to below $1/kg in

Europe and 70 cents/kg in the US – then the technique could be viable. That makes it

imperative for producers to invest in the development of hydrogen-related

infrastructure. Government subsidies and support will be needed to encourage

investment, especially in China, which produced more than 50% of the world’s steel in

2021. Apart from green hydrogen, lack of infrastructure worldwide and labor costs

might pose a challenge for the growth of global green steel market.

RECENT COLLABORATIONS

Hitachi Energy and H2 Green Steel partner to leverage electrification, digitalization, and hydrogen for green steel production. H2 Green Steel will leverage Hitachi Energy’s capabilities to optimize customers’ value chain to plan, build, operate, and maintain the power infrastructure that includes IT and operational technology (OT). The steel production in Boden will use green hydrogen instead of coal in a fully integrated process using end-to end digitalization, which reduces up to 95 percent CO2 emissions compared to traditional steelmaking. This will be equivalent to removing 3 million passenger cars per year from road.

British Petroleum and Thyssenkrupp Steel form strategic collaboration to support decarbonization of steel, including the supply of low carbon hydrogen and renewable power. Thyssenkrupp Steel accounts for 2.5% of CO2 emissions in Germany. By replacing the coal-fired blast furnaces with direct reduction plants where iron ore is reduced with low carbon hydrogen, Thyssenkrupp Steel intends to make steel production climate-neutral in the long term. British Petroleum is focusing on working with corporates in key industrial sectors that have significant carbon emissions to help them decarbonize. The company’s ambition is to be a net zero company by 2050 or sooner, and to help the world to get to net zero.

The Adani group and South Korean steel major POSCO have entered into a deal to explore business cooperation opportunities, including setting up a

green, environment-friendly integrated steel plant at Mundra, Gujarat. The investment is estimated to be up to $5 billion. Both Posco and Adani plan to further collaborate at the group level in other sectors such as renewable energy, hydrogen and logistics to respond to their global carbon reduction requirements. They plan to tap renewable energy sources and green hydrogen, in line with their ESG (environmental, social and governance) commitments to sustainability and energy efficiency.

Rio Tinto has signed a memorandum of understanding (MoU) with Germany-based steel production company Salzgitter to work together on carbon-free steelmaking. Under the terms of the MoU, the two companies

will study the optimization of Rio Tinto’s high-quality iron ore products for use in Salzgitter’s SALCOS green steel project in Germany. Rio Tinto produces iron ore pellets and concentrate at its Iron Ore Company of Canada and iron ore lump and fines in Western Australia’s Pilbara region. The collaboration will explore ways to optimize iron ore pellets, lump and fines for use in hydrogen direct reduction steelmaking.

JFE Steel Corporation and Tohoku University jointly announced today that they established the Collaborative Research Laboratory for Green Steel on February 1 to research eco-friendly steel materials and production methods for the carbon-neutral era. The lab will provide an environment for interdisciplinary industrial-academic collaboration between industry engineers and university researchers from February 2022 to March 2025.

Collaborative research at the lab will be targeted at resolving issues to realize low-carbon steelmaking processes through multifaceted approaches. JFE Steel will utilize Tohoku University’s latest numerical analysis technologies in planned experiments.

RWE and Thyssenkrupp plan partnership for green hydrogen based steel production. Green hydrogen from an RWE Generation electrolyzer could help Thyssenkrupp Steel Europe sustainably reduce CO2 emissions from steel production in the future. The energy company and the steel producer have agreed to work together towards a longer-term hydrogen partnership. The first hydrogen is set to flow to the Duisburg steel mill by the middle of the decade.

Vedanta-Iron and Steel Business has recently partnered with IIT Bombay (IIT-B) on an R&D project to develop cost-effective technology for producing Green Steel using hydrogen targeting significant carbon footprint

reduction in Iron and Steel space.

INSIGHTS & CONCLUSION

The study suggests that using DRI (directly reduced iron) by green hydrogen for

making steel in EAF (electric arc furnace) is the cleanest route for making green steel

at present. The primary source of carbon dioxide (CO2) emission in steel making

process is during iron reduction. So, if CO2 emission during iron making is minimized

the overall carbon-neutral steel making is achieved easily. DRI process emits upto 20%

lesser CO2 to as compared to traditional blast furnace (BF) routes. Apart from that,

recycling of scrap iron/steel using EAF is also a good and majorly used technique to

reduce CO2 emission.

Most of the patents filed are related to BF/BOF efficiency improvement programs

followed by DRI route utilizing natural gas to reduce the greenhouse gas emission.

Many recent patents have been filed that disclose using hydrogen for DRI making to

curb the issue of greenhouse emission. Patent activity shows a sudden surge in

innovation and patent filing after 2014, specially in China. More than 60% of the

inventions originated in China, Japan, and USA as suggested by the priority data. Kobe

Steel is leading in terms of number of patent families filed; however most of its

patents are focused on DRI using natural gas and BF/BOF efficiency improvement.

POSCO being second to Kobe Steel holds most number of patents that mention using

hydrogen to reduce ores to solid iron and subsequently using it for steel making. Kobe

Steel and Primetals Technologies respectively own the maximum numbers of granted

patents. More than 50% of the patents filed are alive. Our patent portfolio strength

scores for top 5 assignees (i.e. Kobe Steel, POSCO, Primetals Technologies, Nippon

Steel, and Tata Steel) suggest that POSCO owns better patent portfolio from the

perspective of futuristic technology to achieve greenhouse emission reduction.

The growth market for green steel is in a nascent stage but slowly gaining pace. Many

steel companies have started investing in building the infrastructure to build carbon-neutral steel. Recently in 2021, HYBRIT, a joint initiative of SSAB, LKAB and Vattenfall, have produced the world’s first hydrogen-reduced sponge iron at a pilot scale. The HYBRIT initiative eliminates around 90% of emissions in conjunction with steelmaking. The hydrogen used in the direct reduction process is generated by electrolysis of water with fossil-free electricity, and can be used immediately or stored for later use. Similarly, H2 Green Steel has announced that it has signed customer contracts for more than 5 to 7 years with a range of cross-industry players. The deals cover over 1.5 million tonnes per year out of the planned initial yearly production volume of 2.5 million tonnes, according to the company. Some companies, like Thyssenkrupp aim to feed hydrogen directly into traditional coke-fueled blast furnaces, making use of existing infrastructure to achieve more modest emission reductions. Austria’s Voestalpine is involved in a more radical project called SuSteel that aims to use hydrogen plasma to reduce iron ore.

Despite the promising new steelmaking technologies, they currently operate on a scale that is not ready to completely replace the traditional blast furnaces. Also, although the prices of renewable electricity and green hydrogen are falling fast, the capital costs of setting up new plant, and shuttering old ones, are still a major barrier to change across the industry. This suggests that achieving a net-zero industry requires

perpetual subsidies compared to the current policy and market environment.

There is still a long journey to completely transform the steel industry towards carbon-neutral steel. The shift towards hydrogen-based steel won't happen overnight and is

only one key production technology that can be leveraged to achieve a carbon-neutral

steel industry. Future availability of cheap energy from renewables and regulation will

act as the two key driving aspects for the adoption of hydrogen-based steel. A clear

and clean roadmap must be followed that combines long-term goals with actionable

quick wins to allow for a gradual shift toward green steel that keeps all stakeholders

on board.

Download the pdf report here:

Please feel free to get in touch if you need a similar but more detailed landscape report or valuation report on a technology domain. Also, if you need a patent search partner who not only understands your technology, industry, and needs, but also stay with you on each step during the course of assignment and make sure you get the results crucial for your win, then you are at the right place. Clubbing the experience and expertise of our techno-legal experts, and AI-powered tools, we provide IP Services that help You Succeed. Get in touch with your queries.

#greensteel #fossilfreesteel #carbonneutralsteel #DRI #directlyreducediron #hydrogenDRI #blastfurnace #BOF #EAF #electricarcfurnace #steelmaking #SustainableDevelopmentGoals #SDG #wipogreen #Booleanipconsulting #IPconsulting

Comments